Throughout the Cold War, the highest threat level the US military saw was DEFCON 2, and it happened on maybe two occasions. First was during the Cuban Missile Crisis, and the putative second may have occurred during 1989 as That Empire was in its death throes.

Likewise, the highest economic threat level we've seen in recent well-documented times has been the Great Depression, when global trade fell and banks failed around the world. Reactionary protectionist tariffs then made matters worse. Having suffered through a vast economic collapse and lacking incentives to work together, humanity then fell to war-making.

In Europe, several countries' banks are in trouble: 1) they hold significant amounts of their home country's sovereign debt and 2) people know this. Consequently, people have been increasingly pulling money from their local banks, such as we've seen for Greece.

Due in part to the austerity economic regimes in place in Europe, world-wide demand for goods has fallen. Since September, shipping costs from China to Europe have fallen 40%. While the supply of ships is fairly inelastic as dry bulk carriers don't have much else they can do other than move stuff across water, this does indicate that European demand for Chinese goods has fallen further recently. An export-oriented economy like China may seek to stimulate demand by devaluing its currency or by creating hidden subsidies for exporters.

We would then expect to see retaliatory trade measures from countries, thereby further disrupting global trade. Combined with bank failures starting in Europe, we would have the necessary preconditions for another Great Depression.

We're at DEFCON 3, and insurance is not cheap.

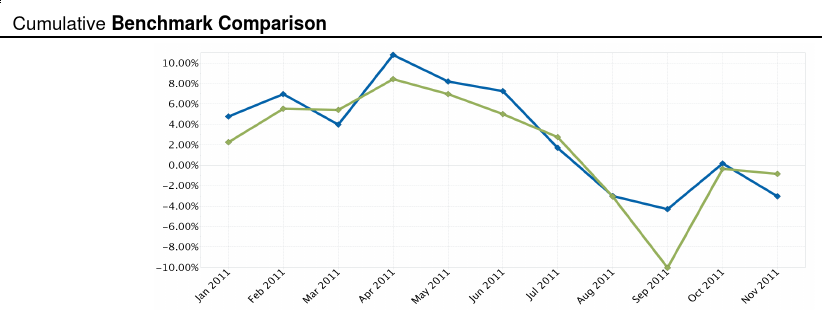

The Treasury Fund is down 3% for the year due in part to the cost of hedging and our large holding in various Too Big To Fail banks. Regardless of what happens, banks will most likely continue to be profitable engines of credit and subject to the same consolidating industry pressures we have seen for the past two decades.

Granted, for these banks to regain their footing, we need different economic conditions than we have today.