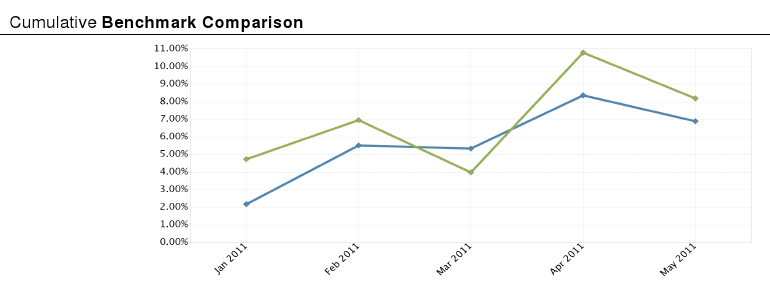

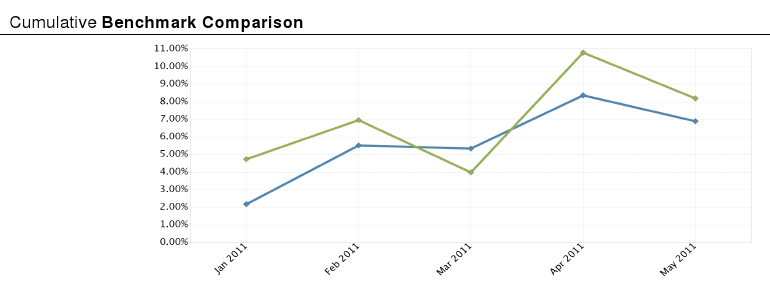

Over the last month, most equity markets have been bouncing down more often than up. When one market goes lower, other markets tend to also go lower, i.e. markets become more correlated during downturns. Insuring an equity portfolio indirectly costs less than direct insurance, and this last month did not invalidate this approach.

The increase in euro-based worries struck our European bank holdings hard, while our insurance appreciated due to a similar fall in the Australian equity markets. One shortcoming of this approach is that the correlations aren't stable and we do not yet dynamically adjust our hedges to match. This is evidenced by the relative outperformance of the S&P 500 over the last month by roughly a percentage point.

Seemingly overvalued markets should fall by larger percentages than one's hopefully more stable investments, therefore one should be able to purchase the same amount of downside coverage for less in the overvalued market. While it'd be nice to not have to spend the money on insurance, life doesn't care and will probably throw something adverse at us sooner rather than later.