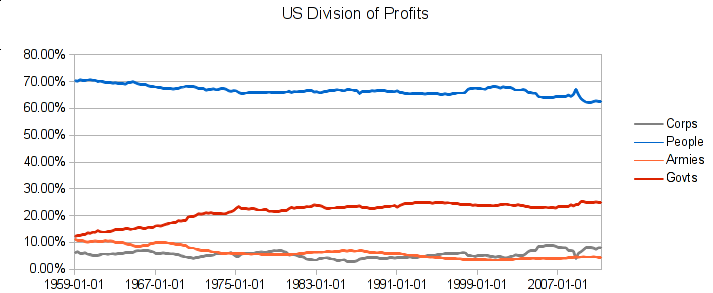

Wars and Police capture are not included in Army profits

No reliable data on Religions' profits

Source: St Louis Federal Reserve data series DSPI, GEXPND, FDEFX, and CP

While individuals occasionally dominate, most places have a perpetual competition for power. Every year, the people work the land and the powerful split the resultant profits.

The People, Corporations, Governments, Armies, Religions: each fights for their share. In the United States over the past 50+ years, the People have been slowly ceding their share of the profits.

It seems that many people point to the recent uptick in corporate profits and blame current woes on corporations, especially financial firms. This appears partly correct because the divide between Capital and Labor has been increasing. The People have been capturing less profits at the same time that other poorer, more populous nations have become much more competitive: with the numbers of laborers increasing rapidly, Capital has become more valuable.

Others point to Government, seeking to reduce the amount it captures. The first half of the 20th century saw a great expansion in total annual profits for the land while Government adopted corporate management and marketing techniques to increase and defend its taking.

The Department of War became first the Department of Defense and currently the Department of Homeland Security. While Armies' capture appears to be increasing, we do not have good numbers for it. Likewise, we have anecdotal evidence of Religion using modern marketing and no numbers to show for it.

The present and future value of the land is heavily impacted by the balance or imbalance between powers. Although an increase in Corporate Profits bodes well for The Treasury Fund, it is difficult to imagine higher long-run performance while the profits for the People continued to erode.

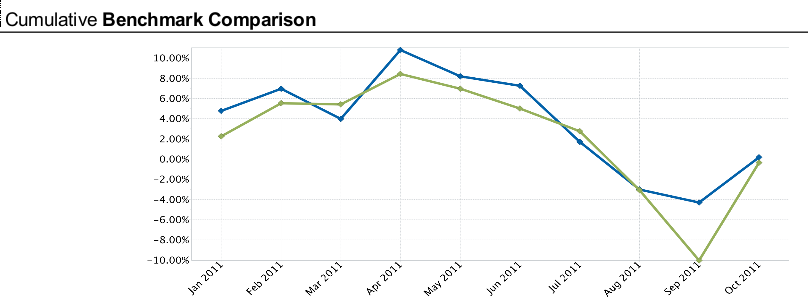

Perhaps due to these concerns or similar, both the S&P500 and TTF have little to show for the year:

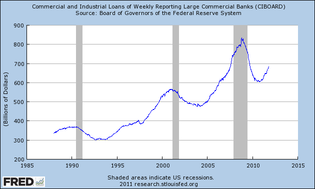

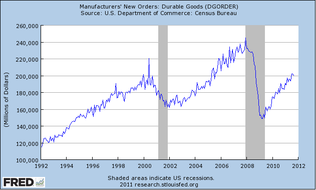

Despite anticipated lower sales demand from Europe and the US, corporations in aggregate seem somewhat sanguine as both business loans and durable goods orders have been steadily increasing.

TTF has maintained its hedges as global liquidity issues remain: witness the recent death of MF Global. We may yet see an unfolding of further destabilizing events.