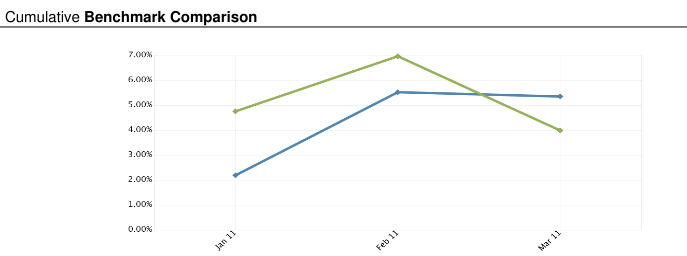

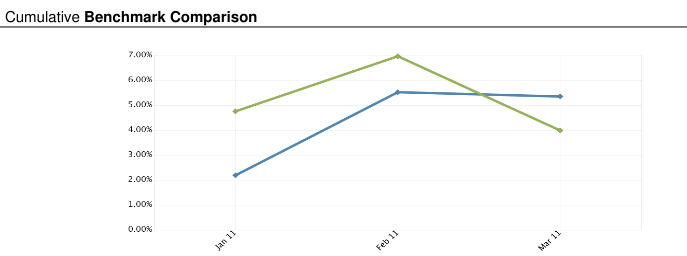

March saw an increase in volatility as markets thrashed over the events in Japan. While our holdings were not directly exposed to the disasters, the collective increase in selling created buying opportunities for those with cash available to do so.

At the beginning of the month, some of Seth Klarman's Baupost Fund's investor letters became available for the years 1995 to 2001. Klarman wants his fund to return absolute value in that he doesn't really care what indexes do, he just doesn't ever want to lose money.

His letters show him spending ~2.4% of his capital every year to hedge market exposure, presumably by buying far out of the money puts. Over the late summer of 1998, when many markets were in turmoil and Long Term Capital Management failed, Klarman's hedging did not provide adequate protection. Imagine watching a hedge not perform, knowing that your investors will have very pointed questions about what the 2.4% capital burn was for.

However, Klarman stuck to his guns, presumably after re-evaluating Baupost's positions, and continued to hedge returns. This presumably paid off from 2001 on, as Baupost's assets under management have grown considerably.

Given that we want to buy insurance, we want to buy the cheapest performant insurance. However, any one particular policy only performs over a range of outcomes. When an insurance company collapses and can't pay claims, that hedge has not worked. Not only do we have to estimate insurance needs, we must also estimate an insurer's ability to pay.

Assuming that we can find matches between insurance needs and an insurer's capabilities, when is insurance too costly? Actuaries would grab as much data as they could and try to model the real world. Financiers would look at the over-worked Actuaries, decide that's too much work and liable to model bias anyways, and solve it by assuming that a historically known price proxy will continue to work, and then characterizing the distribution of returns for that proxy for as far back in history as possible.

With these views into pricing insurance, we can then head into the market and find as many ways as possible to hedge our returns. Easy, right?

This month is a reminder to have high-probability-of-working hedges in place.