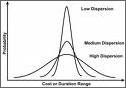

Spent a bit of today trying to get through a backlog of

podcasts from econtalk and it conversations.

The econtalk with Paul Romer and

itc with Nassim Nicholas Taleb and the

Peter Thiel talk at the Singularity Summit all

touched on non-normal probability distributions in the context of managing risk to make yourself or the place

around you better.

Spent a bit of today trying to get through a backlog of

podcasts from econtalk and it conversations.

The econtalk with Paul Romer and

itc with Nassim Nicholas Taleb and the

Peter Thiel talk at the Singularity Summit all

touched on non-normal probability distributions in the context of managing risk to make yourself or the place

around you better.

Taleb has spent the last few years running around posting signs around situations that have non-normal distributions and

massive negative payouts. The front of the sign says "Here be Dragons!" and the back of the sign says

"You're probably not as smart as you think you are.". It seems to him that in finance, we see interesting chains of new events

that periodically result in either a boom or a bust.

Since he runs money, he wants to make bets that pay off when a boom or bust happen, so he buys options and presumably also goes long

on volatility like the VIX. Regardless of direction up or down,

when situations destabilize,

he makes money.

Thiel follows on that with the nice observation that selling insurance (Taleb would call this foolish) has 4 result conditions: 1)

nothing happens and you make some money; 2) something small happens and you lose money that you cover

by selling enough insurance, 3) something big happens and the

government bails you (looking at you, AIG), or 4) the world ends and you don't care.

On the other hand, you also can make a bunch of small investments in biotech or some promising area, and if one pays off, you're set.

Romer points out that while it'd be nice to invest in the company that invents a cancer vaccine, we still get the benefits

of having a cure for cancer. So, it's the institutions and culture that foster the combination of people, material, and ideas

that matter over all else to our general welfare. While other cultures may show short-term investment potential, unless

they have / develop "proper" institutions ("proper" = still improperly defined ;), they will not have long-term potential.

Of course, while the US has apparently benefited from having the "proper" institutions, the US may have or now be in the process

of disassembling those institutions and we wouldn't know.

Say you were back in high school or college, and 1) you were plotting a

potential life course, and 2) you knew the above probability info, and 3), you

believed that pretty much any high-paying job would have many interesting

features. What could you do?

Taleb and Thiel would urge you to go into a field where the median pay outranks most other professions and

had a power law distribution of pay, so that

with some work and luck, you have a chance of making a slew of money. And worst case, you're probably making

more than you would in any other job. So now you just need the data. And luckily, the US Bureau of Labor Statistics

provides some of it (they don't publish data on incomes greater than $140K per year).

From the wage data breakdown by percentile, you can roughly characterize the distribution. And given the

US employment projections by occupation for the next decade, you can

choose your career accordingly.

Naturally, that leaves the following questions: 1) how will you invest your money so as to avoid a possible market meltdown

at retirement age? and 2) how will you live your life?

Spent a bit of today trying to get through a backlog of

podcasts from econtalk and it conversations.

The econtalk with Paul Romer and

itc with Nassim Nicholas Taleb and the

Peter Thiel talk at the Singularity Summit all

touched on non-normal probability distributions in the context of managing risk to make yourself or the place

around you better.

Spent a bit of today trying to get through a backlog of

podcasts from econtalk and it conversations.

The econtalk with Paul Romer and

itc with Nassim Nicholas Taleb and the

Peter Thiel talk at the Singularity Summit all

touched on non-normal probability distributions in the context of managing risk to make yourself or the place

around you better.