European bank stocks have been hit hard over the last month. Vulnerability to the Euro sovereign debt crisis, weakening economic data in both the Euro area and the United States, and the apparently increased likelihood of a euro currency failure, all increase uncertainty regarding Europe's banks' valuations.

Selling into weakness does not make sense as long as nothing material has changed. While the poor economic news has pushed back these investments' expected timeframes, the most probable effect of this crisis will be to create a consolidation in European banks. If that future becomes more certain, more funds will flow into those winning banks.

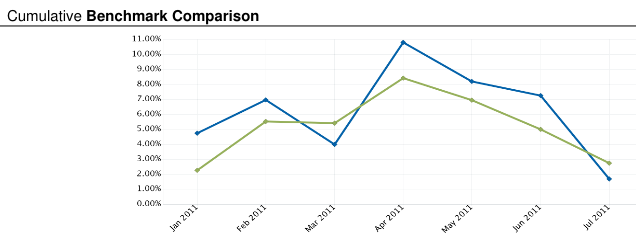

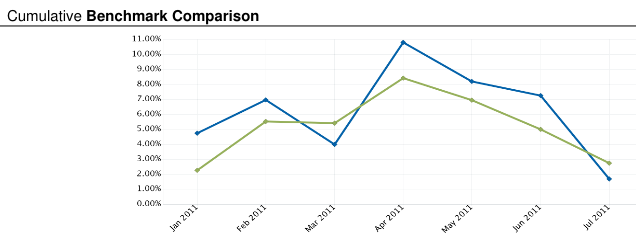

While we wait, the fund's performance has been impacted a) by the european banks held, and b) the relatively slower-to-collapse Australian and Brazilian markets.

Time will tell how the AU and BR hedges work out, however at the week-level, timing differentials exist. As always, there is room for improvement.