While US equities have fallen, European equities and especially their banks have been hit hard. Deutsche Bank shares have fallen ~40% from their spring highs, which sadly seems to be par for the group. Simultaneously in the US, the mega-banks have seen their shares fall. Overall it has not been a good month to own bank shares.

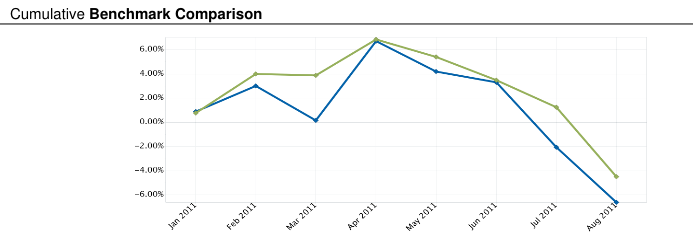

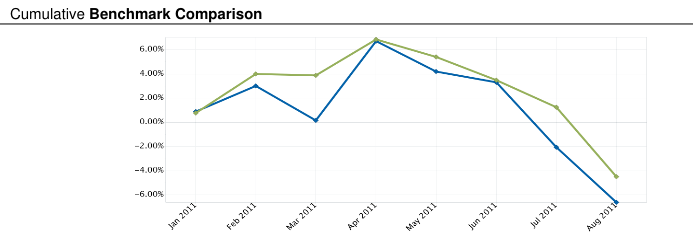

The return of the fund has mirrored drops in European bank shares, although our hedges prevented larger losses. Europe may devolve into a full-fledged bank panic, so we have hedged against increases in the LIBOR. The odds of a major panic seem low as Europe will probably force aggregation of banks (like in the US) and also force the creation of an FDIC equivalent. However we may think, others are pessimistic and that possible future has such a large negative downside.

Over the month, we cashed out our hedges, recreated them at lower prices, and used the proceeds to purchase more shares. We initiated holdings in several agency-debt REITs as it seems unlikely that regulatory agencies will change their stance with regards to leverage since that would reduce demand for bundled mortgage securities.