Fraud Auditing and Forensic Accounting by Tommie Singleton, Aaron Singleton, Jack Bologna, Robert Lindquist

Fraud Auditing and Forensic Accounting by Tommie Singleton, Aaron Singleton, Jack Bologna, Robert Lindquist Fraud Auditing and Forensic Accounting by Tommie Singleton, Aaron Singleton, Jack Bologna, Robert Lindquist

Fraud Auditing and Forensic Accounting by Tommie Singleton, Aaron Singleton, Jack Bologna, Robert Lindquist

First: That the defendant has made a representation in regard to a material fact;

Second: That such representation is false;

Third: That such representation was not actually believed by the defendant, on reasonable grounds, to be true;

Fourth: That it was made with intent that it should be acted on;

Fifth: That it was acted on by complainant to his damage; and

Sixth: That in so acting on it the complainant was ignorant of its falsity, and reasonably believed it true.

(Donald) Cressey decided to interview fraudsters who were convicted of embezzlement. He interviews about 200 embezzlers in prison. One of the major conclusions of his efforts was that every fraud had three things in common: (1) pressure, sometimes referred to as motivation, and usually an "unshareable need"; (2) rationalization of personal ethics; and (3) knowledge and opportunity to commit the crime. We carefully note that the ones that weren't caught, also weren't interviewed.

The researchers (Mark Beasley, 2001) studied all of the cases to determine why the financial auditors had been charged with violations. The most common problem with the auditors was lack of professional care (71%), with inappropriate level of professional skepticism (60%), and overreliance on inquiry as a form of audit evidence (40%) as the next two common problems. Two additional problems were failure to corroborate management's explanations that were inconsistent or refuted by other evidence (36%) and assuming internal controls exist when they may not (24%).

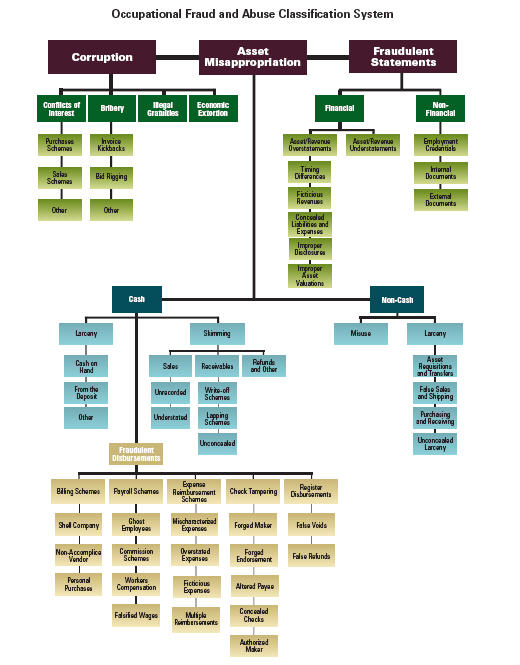

Additionally, the ACFE Fraud Tree on page 102 seen below, and the chapter on Red Flags starting on page 127 should exist in the back of everyone's minds as they review transactions.