Similar to AreBanksCheap, some insurance companies have been hammered by the market for holding municipal bonds. See the big guilty list over at bond buyer. However, the market doesn't seem to be distinguishing between general obligation municipal bonds (backed by the full faith and credit (lol)) and revenue bonds (backed by the revenue from a project (like a hydroelectric dam)).

The composition of municipal holdings should matter; so maybe something else is moving the market. Maybe people believe that we've had it too good recently, and we're in for a more disaster-filled 2011.

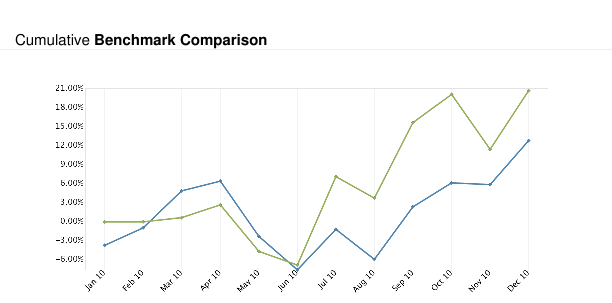

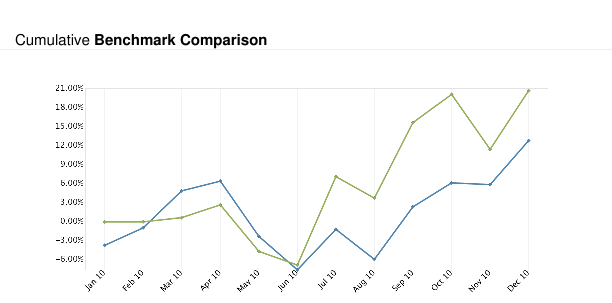

I hope that's not the case, I'd certainly like to keep the green line (me) above the blue line (S&P 500). Granted, it's as the Germans say, "Man weiss nie was kommt" (one never knows what's inbound).