It's always time to buy something; given the world of opportunities there's a good chance something is attractively priced.

However, what you buy over time will certainly change. While some car makers seem like valid purchases now, the health industry seems a better long-term choice due to the simple fact that as we earn more, we will spend more on keeping ourselves alive and healthy.

Though we may plan for a ruddy-cheeked senescence, the markets seem to have a more volatile future. From the latest ying4 zhuo2lu4 (hard landing) PMI numbers from mainland China to the inverted yield curve in Brazil to rapidly slowing growth in US personal consumption, the world presents much ill news.

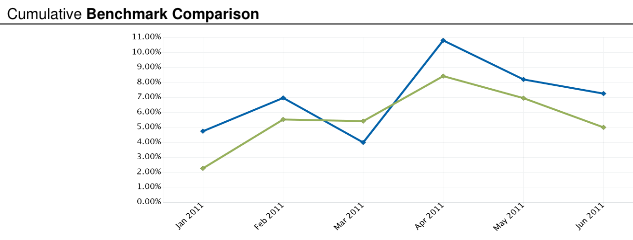

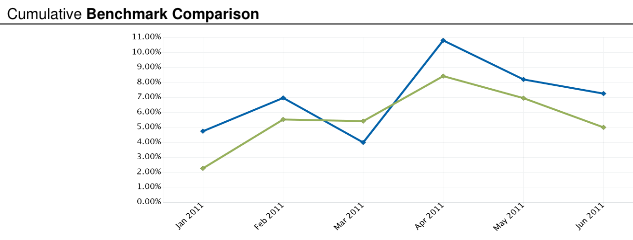

Accordingly, the fund's hedges against various market drops (Australia, Brazil, and Gold) have increased to 4 percent of total holdings, which allowed us to avoid much of the volatility in June's markets.