Thirteen Bankers by Simon Johnson and James Kwak

Thirteen Bankers by Simon Johnson and James Kwak

Thirteen Bankers by Simon Johnson and James Kwak

Thirteen Bankers by Simon Johnson and James Kwak

Arguing for a return to increased regulation for the banking sector, Johnson and Kwak seek to use the financial crisis to reduce the economic/political power of banking. Their reforms address neither the basic Minsky-speculative nature of banking nor the Friedman-Schwartz-Bernanke requirement to prevent bank failures from reaching critical mass and impairing the flow of credit to businesses.

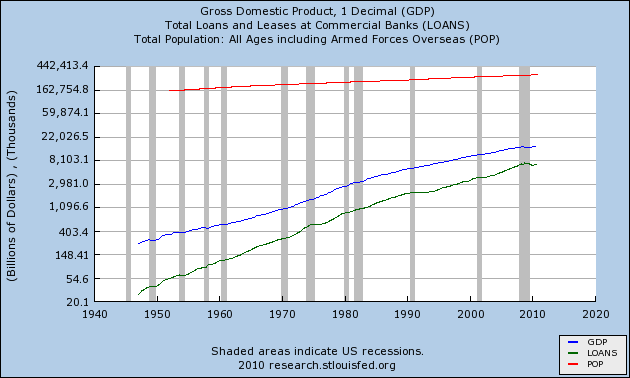

Most disingenuously, they pin the stability of the post-Depression banking solely upon Regulation. Nowhere do they discuss the role of debt and the change from the debt-fearing Depression generation to the debt-loving current generation. Debt in the US has grown faster than GDP since 1950, maybe because our regulatory institutions got better, and maybe because we were able to carry more debt after the Depression's Great Zero'ing. As the delta between economic growth and debt growth narrowed, banking also became less stable. Is the instability of the last few decades due to either of these potential explanations, or to something else? The jury's still out...

The result (of the 1933 banking reforms such as the Banking Act of 1933) was the safest banking system that America has known in history, despite a substantial increase in leverage...

the half-century following the Glass-Steagal Act saw by far the fewest bank failures in American history. But once financial deregulation began in the 1970s, these low equity levels became increasingly dangerous.

However, another common feature of emerging market crises is that they don't last forever...

A lower exchange rate boosts exports, widespread unemployment reduces the cost of labor, and companies with rescheduled debts or new companies with clean books can take advantage of both higher sales and lower costs. Surviving businesses can use their increased market shares and reaffirmed political connections to grow bigger and stronger. The oligarchs who run them can become even wealthier; Carlos Slim bought up companies on the cheap after the 1982 crisis in Mexico and used the boom-bust cycle of the early 1990s (and his strong political connections) to consolidate his dominant position in telecommunications -- becoming one of the world's richest men in the process.

But reducing the size, profits, and power of the big banks will begin to restore balance both to our economy and to our political system.